Brown University's endowment saw an 11.3% return on investments in fiscal year 2024, eclipsing last year’s returns of 2.7% and generating $728 million, the University’s Investment Office announced in a press release.

The endowment is now worth $7.2 billion — a record high and a 9% increase from last year — including another $203 million in endowed gifts.

This year marks the highest return the University has seen since the 2021 fiscal year, when stock market increases spurred by the pandemic led to a return of 51.5%, followed by -4.6% in FY22 and 2.7% in FY23. This year’s returns more closely mirror those in pre-pandemic years, when the endowment tended to earn between 10% and 13% per year.

“FY24’s return suggests that those distortions are mostly behind us,” Deputy Chief Investment Officer Joshua Kennedy ’97 wrote in an email to The Herald. “This fiscal year saw very strong stock market returns, as the Federal Reserve contemplated cutting interest rates and enthusiasm grew for technology stocks benefitting from generative AI.”

The University put $281 million in endowment funds toward “financial aid and student support, scientific research and other priorities,” the equivalent of $26,171 per student and approximately 21% of Brown’s operating budget.

Thirty-five percent of the endowment's contribution to the operating budget will go toward financial aid in the form of scholarships, fellowships and prizes, according to the Investment Office. Funding for endowed professorships accounts for another 22%. The rest of these funds are split between categories like general University funds, research, libraries and athletics. The exact breakdown of funding allocation depends on the “designated purpose” with which donors made each gift.

“The Investment Office’s charge is to protect and prudently grow the endowment over time, to ensure its role as an enduring financial resource that provides long-term support and advances Brown’s mission,” Chief Investment Officer Jane Dietze said in the release.

To ensure “strong risk-adjusted returns over decades,” the Investment Office relies on a team of investment managers who strategically invest endowment funds, Kennedy said.

Brown places in the top quartile for 2024 endowment returns among peer institutions as well as the top 5% over five- and 10-year terms, according to the University. Annualized returns over three, five, 10 and 20 years are 2.8%, 13.1%, 10.8% and 9.5% respectively. Under President Christina Paxson P’19 P’MD’20, the endowment has earned around $5.7 billion over the last 12 years, according to data from the Investment Office.

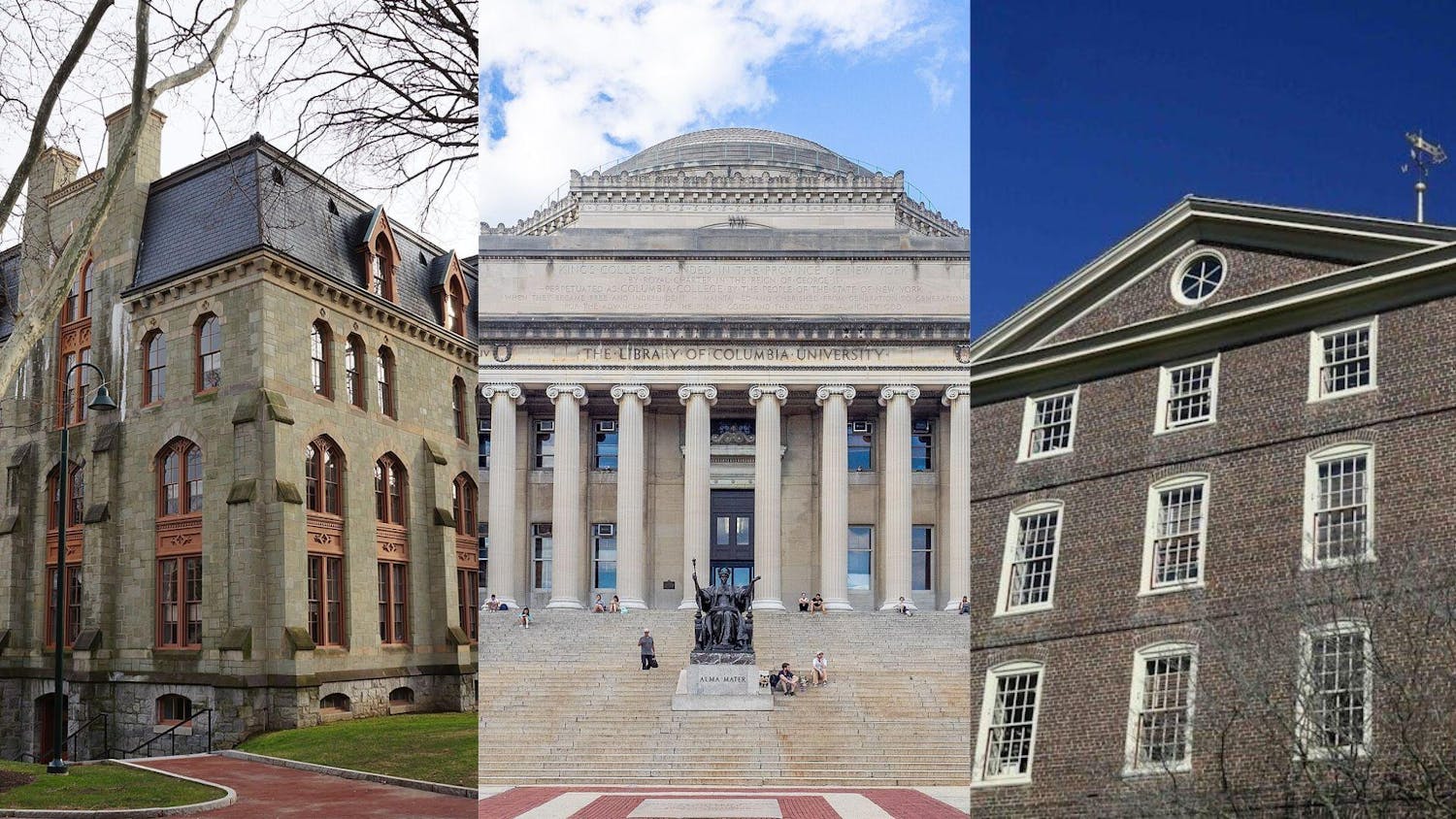

Columbia reported an 11.5% return on endowment investment for FY24 while Dartmouth’s endowment earned an 8% return. The rest of the Ivy League schools have yet to disclose their endowment returns for the most recent period.

Correction: A previous version of this article incorrectly described Brown's endowment's contributions to the operating budget. The Herald regrets this error.

Anisha Kumar is the senior editor of community and standards of The Herald's 135th editorial board. She previously served as a section editor covering University Hall and international student life. She is a junior from Menlo Park, California concentrating in English and Political Science who loves speed-crosswording and rewatching sitcoms.