The sticker prices of colleges can be shocking to prospective students and their families. Many schools offer financial aid in the form of grants, scholarships, loans and work-study to help alleviate costs. A simplified financial aid calculator — called MyinTuition —recently partnered with the University in hopes of making it easier for students and families to get an idea of how much they will really be paying to attend Brown.

When Phillip Levine, professor of economics at Wellesley College, started thinking about sending his son to college, he wanted to know how much financial aid he was eligible for, but he found he wasn’t readily able to obtain a figure. In response he created MyinTuition, a simplified financial aid calculator consisting of six personal financial questions.

“MyinTuition makes it a lot easier to get at least an initial, ballpark sense of what the cost is going to be,” Levine said. The calculator aims to let users look beyond“the $70,000 sticker price and down to a number which for them might be much more feasible.” Reframing the number“is very useful and opens a door for them that otherwise might be closed,” Levine added.

MyinTuition began a partnership with the University last summer, and the calculator became available for use Jan. 17, allowing prospective students to get an estimate of how much attending Brown would cost.

This calculator can be employed in addition to the federally required net-price calculator to help families quickly calculate their costs without referencing their tax returns, said Dean of Financial Aid Jim Tilton.

Levine agrees with Tilton. “Use my calculator first and get a really quick ballpark estimate, which is fairly precise but not super precise,” Levine said. “At some point, you may want to narrow down the price. And at that point, pull out your taxes, dedicate some time and enter all the values that are asked for.”

According to Tilton, the University worked closely with MyinTuition before rolling out the program.

Tilton hopes that the University’s partnership with MyinTuition will especially benefit middle- and low-income families. “It’s important that moderate and low-income families get a sense of whether or not they could really afford to attend Brown,” Tilton said. “When you’re paying $71,000 worth of tuition, it’s really nice to get a sense of what kind of aid you might be eligible to apply for.”

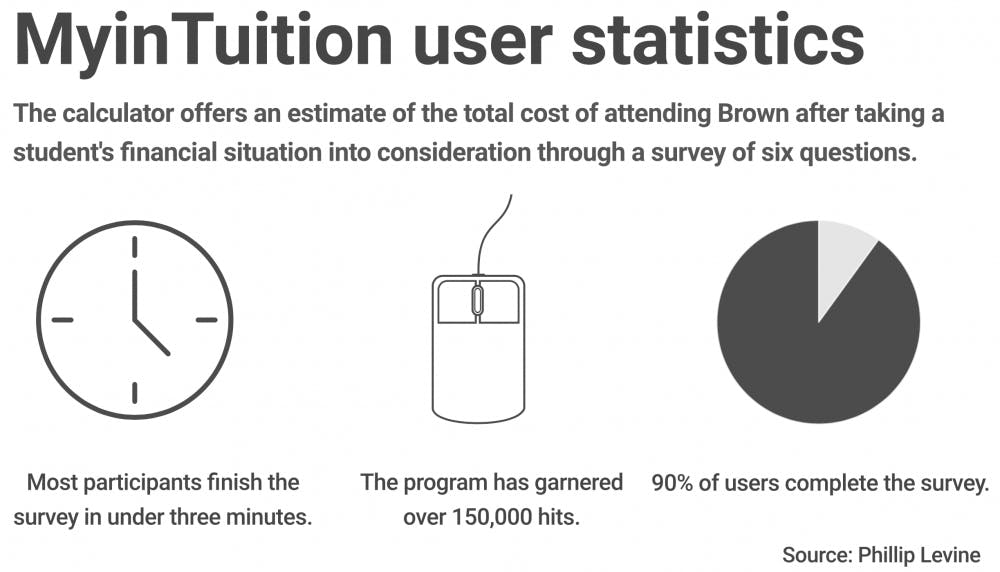

Since its creation in 2013, MyinTuition has partnered with 31 schools and garnered over 150,000 hits. The average completion time of the calculator is under three minutes and 90 percent of the people who begin the six questions finish.

Eric Kim ’21 found the calculator helpful when he was applying to college. “I didn’t want to use the complicated and time-consuming net-price calculator, so when I read about MyinTuition, I checked it out and found the process very simple and intuitive.”

In the future, Levine hopes to reach even more institutions. “Expanding beyond the 31 and into the hundreds would be nice,” Levine said. “Right now, the tool is highly targeted to sort of elite institutions, and pricing issues for students interested in college is relevant in all ranks of institutions,” he added.