Rhode Island State Representative Robert Lancia R-16 proposed a bill on Thursday that aims to increase the number of children who can afford to attend private school. Lancia’s House Bill 7055 would allow for total business donations to need-based scholarships, in exchange for a tax credit, to reach $5 million, as opposed to the $1.5 million cap previously determined by a 2013 House bill, said Sheila Konis, director of Rhode Island Families for School Choice. Bill 7055 comes in honor of National School Choice Week, an annual event that highlights the variety of educational options for students in Rhode Island and beyond.

“Fifteen thousand families are underserved educationally in Rhode Island, and the graduation rate at the Community College of Rhode Island is 3 to 14 percent,” Lancia said, adding that he believes House Bill 7055 will connect students with the educational environment best fit to help them succeed. Lancia presented a similar bill last year, House Bill 6031, that died in the Finance Committee, he said.

The state government began exploring avenues to fund non-public school options for students in 2006. They passed a bill that allowed corporations to receive a tax credit in exchange for donating to organizations that award need-based scholarships for private education, Konis said.

The newly proposed state budget of $9.4 billion means that Rhode Island can afford to give up taxes from businesses that are allowed to donate to scholarship funds, Lancia said. With a $1.5 million cap, only a fraction of a percent of the students in Rhode Island currently use scholarships from tax credit, said Jonathan Butcher, a senior policy analyst at The Heritage Foundation. Allowing for more business investment in need-based academic scholarships may improve graduation rates as a result of increased school choice for students, Butcher added, citing case studies in Washington, D.C. and Milwaukee.

“We have great public schools here, but some students need more than what their town public school is able to give them,” Konis said.

Last year, 130 businesses applied for the tax credit through a lottery, but only 15 received it. If all 130 businesses were granted the tax credit, there would have been a $5.2 million increase in scholarship funds available, she added.

“But we’re capped at $1.5 million,” Konis said. “That makes no sense.”

Members of the Catholic School Parent Federation of Rhode Island showed up for the presentation of the bill.

“The bill is important to us in Catholic schools because an increase in the corporate tax scholarship program will make more money available to offset costs for children in Catholic schools,” said Erin Clark, a member of the federation. “Even a small scholarship amount can really make a difference in whether you can necessarily enroll in Catholic school or not.”

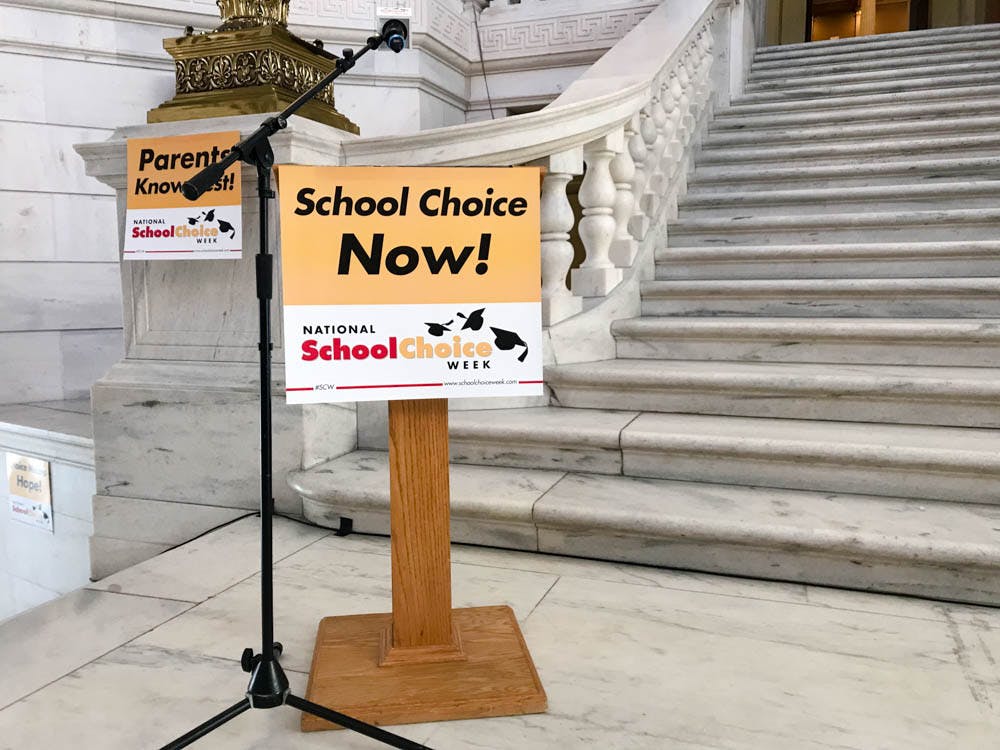

Lancia presented the bill in the midst of a celebration of School Choice Week at the State House, with performances by the St. Pius V school choir, the St. Rose of Lima school band and an introduction by Jason Botel from the U.S. Department of Education.