Graduate students may have succeeded in avoiding taxation of their tuition waivers with the passage of the final GOP tax bill in late December, but many still fear for the security of higher education.

The initial House tax bill revealed the “larger plan to target higher education,” said Diego Luis GS, who participated in protests against the bill in November. “With one swoop of the pen, our entire livelihood could be thrown out the window.”

However, even the final tax bill has left some graduate students worried that future legislation will target education.

“Unless you’re a millionaire or a billionaire, you shouldn’t be happy about the final tax bill,” said Dennis Hogan GS, a graduate student representative to the University Resources Committee. “It’s obvious that Republicans are not friendly to higher education.”

The University is “pleased” that the tax exemption on tuition waivers remains, said Albert Dahlberg, assistant vice president of government and community relations. But the University remains “disappointed” that the excise tax on endowments was passed.

Graduate students shared the same attitude toward the endowment tax. “This sets a precedent,” Tulloch wrote. Though Brown doesn’t meet the $500,000 endowment-per-student minimum for the endowment tax, the new tax could impact financial aid and funding for research in the future, Dahlberg said.

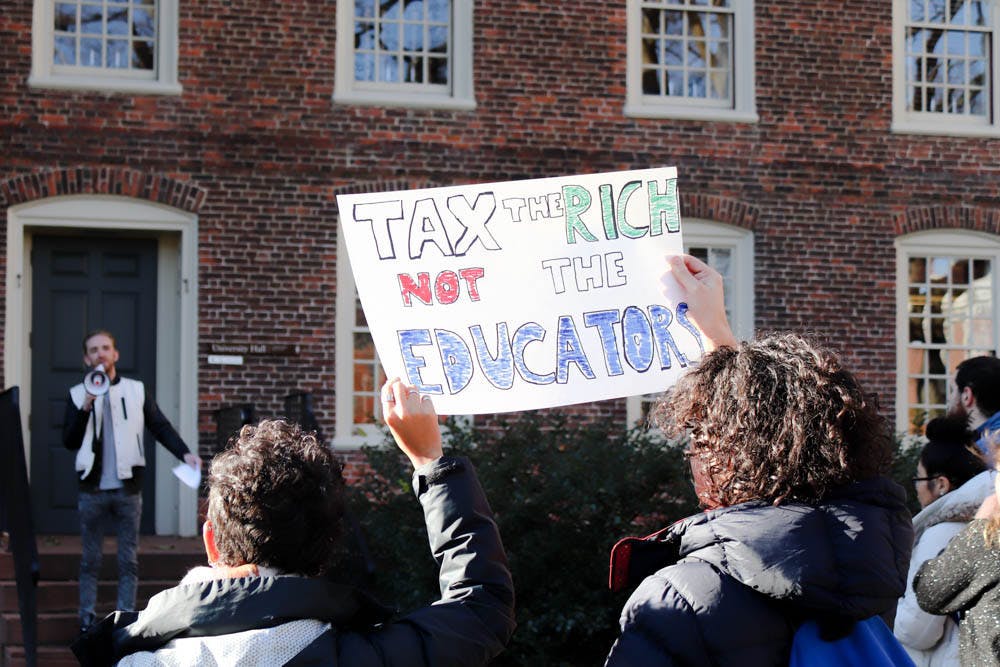

When the House initially passed a tax bill removing the tax exemption on tuition waivers in mid-November, over 50 colleges nationwide saw protests from their graduate students, according to a Columbia press release. Around 100 Brown graduate students protested the GOP bill on the steps of University Hall Nov. 29, The Herald previously reported.

Graduate Student Council Chair of Student Life Andrew Lynn wrote in an email to The Herald that he worked with members of Stand Up for Graduate Student Employees “to alert students of the proposal to remove tuition waiver exemptions from the tax code."

The GSC, SUGSE, graduate students and the University were all “involved in lobbying,” Hogan said. But “it’s hard to claim victory when the bill passed,” he added.

“It’s not just about graduate education,” Luis said. “It’s about the status of education ... in the country.”

Correction: In a previous version of this article, GSC Chair of Student Life Andrew Lynn referred to the group Stand Up for Graduate Student Education. In fact, the group's name is Stand Up for Graduate Student Employees. The Herald regrets the error.