The University’s endowment rose to nearly $3.5 billion over the 2017 fiscal year, according to a University press release. It grew by 13.4 percent, surpassing a preliminary benchmark of 11.1 percent.

Compared to 145 peer colleges and universities, the endowment had strong returns, according to data from Cambridge Associates. The median return this year was 12.9 percent, though this number is subject to change as more universities report their returns. In the past three-, five- and 10-year periods, the University’s “returns have exceeded the threshold of the top quartile of that universe,” wrote Joseph Dowling, chief investment officer, in an email to The Herald.

Including Brown, only five Ivy League universities so far have publicly released their endowment returns. Brown’s endowment returns outperformed Harvard and Cornell, which saw returns of 8.1 percent and 12.5 percent, respectively. Dartmouth led the Ivy League for fiscal year 2017 with a 14.6 percent gain followed by Penn at 14.3 percent.

“While these are excellent results and it is important to be accountable to independent benchmarks such as peer returns, the essential goal is to provide the University with the financial support and flexibility it needs to achieve its goals,” Dowling wrote.

This year, 35 percent of the endowment was invested in absolute return strategies, 27 percent in public equity, 21 percent in private equity and 5 percent in real assets, according to documents obtained by The Herald from the University’s Investment Office.

The year was “an exceptionally strong 12-month period for global equity markets,” Dowling wrote. “The endowment’s exposure to equity markets, both through professional investment managers and investments in passive indexes, drove an excellent return for the year.”

The Morgan Stanley Capital International All Country World Index, the index most representative of equity markets, saw an 18.8 percent return, according to the document. But commodities and bonds did not perform as well.

Most assets — 75 percent — were invested in North America because it is “the market with the most favorable risk-reward in the current environment,” according to the document. Thirteen percent was invested in Europe, 10 percent in Asia, 2 percent in the Middle East and Africa and 1 percent in Latin America.

Despite the successful year, Dowling emphasized that the investment team is focused on “long-term performance of the endowment.”

“The purpose of the endowment is to support the education mission of the University, and the University is managed as a permanent institution, so the endowment needs to be as well,” Dowling wrote. “The return for a single year for the endowment is approximately equivalent to how fast you ran a single mile in a marathon. You’re pleased if you ran a fast mile, but you keep your focus on the larger goal.”

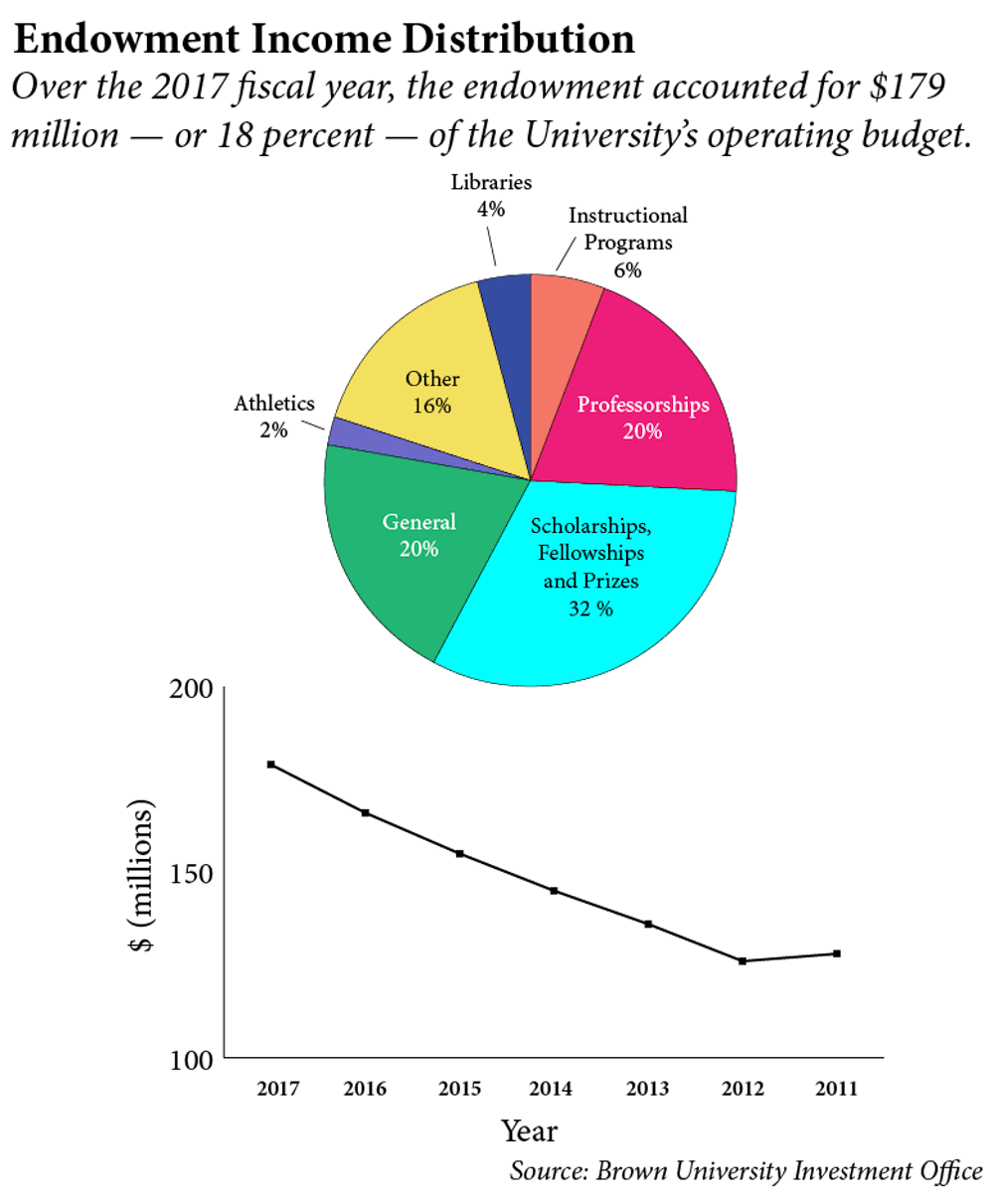

The endowment distributed $179 million to the University in the 2017 fiscal year, funding 18 percent of the University’s operating budget. Nearly a third of the contribution financed scholarships and fellowships while 20 percent funded professorships. The remaining 48 percent went to instructional programs, libraries, athletics and other uses.