In April, the University switched its health insurance provider, forcing some students who previously qualified to waive the plan and use their own insurance to enroll in the new $3,615 plan.

Facing a price increase, the Insurance Office switched from Consolidated Health Plans to Gallagher Student Health to administer the Brown University Student Health Insurance Plan. The plan is underwritten by United Healthcare, which pays the claim. Gallagher Student Health assists with issues regarding enrollments and waivers.

When students pay their annual tuition, the University automatically enrolls them in its Student Health Insurance Plan. Students can apply for a waiver by filling out information about their current health plan and opt out of the University insurance plan.

The Insurance Office website notes that, this year, all waiver requests were subject to “a new and more robust verification.”

The University requires comparable coverage, which includes plans based in the United States with healthcare providers in Providence and covering services that go beyond emergency care such as pharmacy visits, surgery, mental health and preventive services. Insurance plans that do not cover non-emergency care within Rhode Island, such as out-of-state Medicaid plans, are not accepted under the waiver program.

Some students were initially denied waivers because Gallagher did not recognize their insurance plan.

Max Mines ’20, who is on his father’s Traditional Indemnity plan under Horizon Blue Cross Blue Shield of New Jersey, said that when he tried to waive Gallagher’s plan, the waiver application did not provide his plan as an option. Thus, Gallagher initially deemed him ineligible for a waiver. After approaching the Insurance Office multiple times, they relayed his situation to Gallagher and Mines said he received a waiver.

“It’s problematic when the institution that decides if you’re eligible is also the one profiting from the decision,” Mines said.

The Insurance Office, which consulted other departments such as Campus Life and Health Services, decided to make the switch as University Health Plans gave a renewal quote with pricing that was too costly, while UnitedHealthcare Student Resources offered to provide a similar program at a much lower cost, wrote Jeanne Hebert, director of insurance and purchasing services, in an email to The Herald.

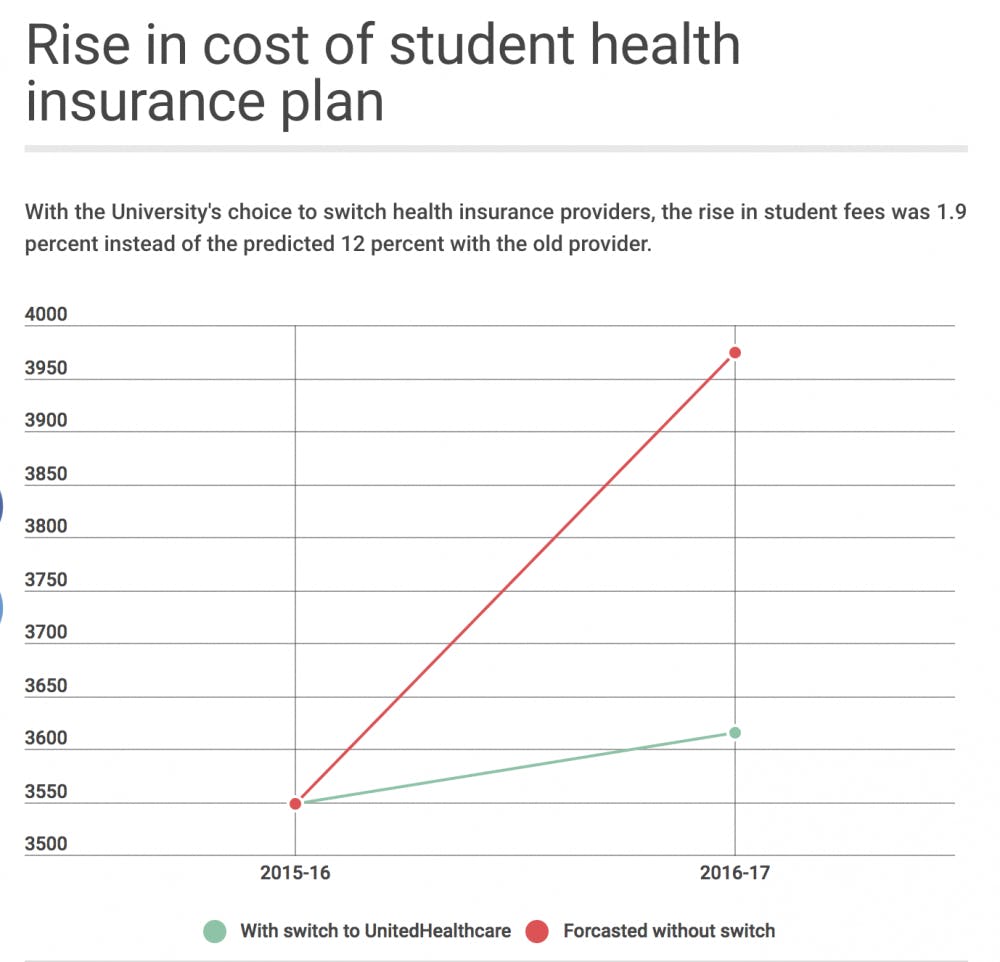

“Had we remained with our previous insurance carrier and claims processor, the cost of the plan would have increased by 12 percent instead of the 1.9 percent increase when changing to UnitedHealthcare Student Resources,” Hebert wrote.

She added that UnitedHealthcare Student Resources is a division of UnitedHealthcare, which offers a national network of providers. This network provides students with coverage even when they are not at the University.

But students do receive some health services from the University already. Annual tuition also includes a $950 fee charged for Health Services, which covers services such as physician visits, EMS ambulance services and mental health counselling at University facilities.

The University is also taking steps to ensure that students can receive affordable coverage. A new initiative started in the 2016-2017 academic year ensures that the provider switch will not impact students on financial aid. The initiative allows students who are on financial aid and denied a wavier to contact the Office of Financial Aid to get funding for the entirety of the $3,615 fee.

Previously, a student on financial aid who did not have comparable insurance would have to borrow a loan or come up with their own resources to cover this fee, said Jim Tilton, dean of financial aid.

“This was really difficult for our low-income students, and the University said that we wanted to make sure our students were taken care of,” he added.