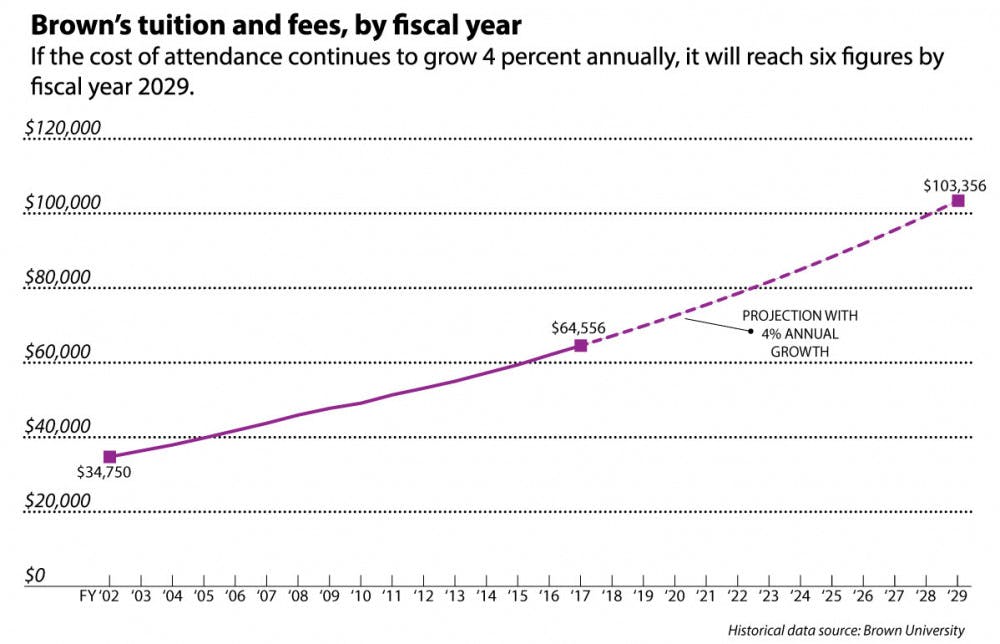

In the 2028-29 academic year, the cost of attending Brown will surpass $100,000 if tuition and fees continue to rise at the 4 percent average rate they have for the last five budgets.

These increases in total undergraduate charges have been accompanied by even larger expansions in financial aid budgets at many schools including Brown, where financial aid spending has increased an average of 6.5 percent per year for the most recent five budgets.

Administrators point to the rising financial aid budget as a sign that tuition increases are not pricing out lower- and middle-income students. Since fiscal year 2008, the cost of attendance has dropped for students receiving financial aid whose families earn less than $150,000 annually.

But for more than half the student body — the 55 percent who do not receive any financial aid — costs continue to mount. Even as the net cost of attendance declines for others, the high and rising sticker price can impose difficulties on those whose family earnings place them just beyond the cusp of financial aid.

The University Resources Committee recognized as much in its 2014 report, which cited two concerns related to high sticker prices. First, they “can deter students from disadvantaged backgrounds from seeking education worthy of their talents because the nature and availability of financial aid is not well understood,” the URC wrote. “The second serious concern is the affordability for families whose earnings are at a level that disqualifies them for significant financial aid at most schools but at the same time are not sufficient to bear the full cost of college with ease.”

“The second issue is far more difficult to address because of the scale of resources that are required under the current model to ease the cost of education for an even broader range of students,” the URC wrote.

Perpetual increases in both tuition and financial aid raise fundamental questions about the long-term sustainability of Brown’s business model — and that of its peers. As the cost of attendance continues to rise and more students and their families feel the financial pinch, more will need to be covered by the financial aid budget. Thus, Brown will need to do what it has acknowledged will strain the current model in higher education: Increase financial aid for those already receiving it, while expanding the group of students eligible for aid.

Constant cost for some

Though total undergraduate tuition and fees are rising, top administrators prioritize constraining a different number: the cost of attendance for lower- and middle-income students.

By that measure, the University has been successful. The average cost of attendance for first-years who receive financial aid and whose families earn less than $200,000 has held steady since Christina Paxson P’19 assumed the presidency in fiscal year 2013, according to data provided by the University.

For first-years who receive aid in some income bands, the average cost of attendance has actually declined even as tuition has swelled over that span.

Data on how the average cost of attendance has changed by income band for the entire student body is not available because the University does not collect information on family income for students who do not receive aid. The University would not disclose the percentage of students who apply for aid but do not receive it.

“When I think about tuition … I think about the distribution of tuition and how much different students are paying to come to Brown,” Paxson told The Herald. “The focus in the past several years has been keeping net tuition increases low for our lowest-income students and, increasingly, for our middle-income students.”

“On equity grounds, it’s important to make sure that students aren’t leaving with too much debt and that tuition is affordable,” Paxson said.

Nonetheless, 55 percent of undergraduates do not receive aid, and for that majority, the cost of attendance has increased more than 4 percent in nine of the last 15 years. And though Paxson told The Herald in 2014 that she wished to bring tuition increases more in line with inflation, inflation-adjusted tuition hikes for fiscal years 2015 and 2016 were higher than those for any year since the recession.

Though Brown has its share of one-percenters, many students who do not receive aid cannot comfortably pay the full cost of attendance. For those who do not qualify for aid, affording Brown can be a stretch, requiring parents to dip into retirement savings and rainy-day funds.

But for students receiving some level of aid, including those with the greatest need, the administration’s support for robust financial aid increases has successfully kept the cost of attendance down in the face of higher tuition.

Sticker shock

While their focus remains trained on the net cost of attendance for lower- and middle-income students, administrators recognize that tuition and fees are high.

“We are paying attention to it,” said Provost Richard Locke P’17. “It’s not like we are happily just (tacking on) 4 percent.”

Brown is not unique among its peers: Of the eight Ivies, six, including Brown, raised tuition and fees by 3.5 percent or more in the last year.

But at some point, the sticker price may become a problem even if the net cost of attendance for low- and middle-income students remains at current levels.

As the sticker price rises, so too must the amount of aid for students already receiving it. At the same time, higher sticker prices will force the University to subsidize students not currently receiving aid whose family income growth does not keep pace with tuition growth.

An increase in the percentage of undergraduates receiving aid — now 45 percent of the student body — would reduce the effectiveness of tuition hikes as a source of new revenue because fewer students would be paying full tuition.

But Brown and its peers have not yet reached the point where the sticker price threatens their economic model or attractiveness to prospective students.

“Clearly, we have many more applicants than we have spaces to fill,” Paxson said. “So in a market sense, (the sticker price) is not at the maximum.”

Administrators point out that Brown’s total undergraduate charges are competitive with those of peer institutions. Brown’s sticker price ranks sixth among the eight Ivies.

The URC has taken this into consideration when making tuition recommendations in its budget proposals. In 2014, it wrote that “the relative position of Brown’s undergraduate charges compared to our peers is unlikely to change as a result” of raising tuition at the proposed rate.

Steven Goodman, an education consultant and admission strategist, said the threshold at which the sticker price jeopardizes university economics depends on the school and its reputation. “That line is extremely nuanced, extremely fluid. At some point that will happen, but (Brown is) not there yet,” he said.

While the University’s cost of attendance does not yet negatively affect application and matriculation decisions, Paxson and Locke said administrators monitor several statistics so that they will know if and when it does.

“We’re tracking very, very carefully certain metrics to make sure we’re competitive,” Locke said. Among those metrics are the number of applicants and the yield rate — the percentage of students admitted who enroll — as well as debt levels for current students.

“At the same time, we’re looking really carefully at what we can do to be more efficient and cut costs and … diversify our income,” Locke said.

Trapped by tuition dependence

Brown’s reliance on undergraduate tuition and fees as a source of income — 34 percent of total revenue for fiscal year 2017 — makes the problems associated with the rising sticker price all the more pronounced.

If tuition continues to rise 4 percent annually, the University would need to increase the financial aid budget by about 6 percent per year to keep the cost of attendance steady for those receiving aid, assuming 50 percent of undergraduates would be aided by the 2028-29 academic year, according to Herald estimates.

In that scenario, 64 cents of every new dollar of tuition revenue would go toward additional financial aid spending that year. Even if the financial aid budget increased only 5.5 percent per year, 56 percent of new tuition revenue would be needed to expand the aid budget.

For fiscal year 2017, that figure is only 39 percent. Fiscal year 2015 saw this figure reach 57 percent — the highest it has been in the past several years.

The higher that percentage gets, the harder it will be for the University to fund other annual budget increases, such as faculty and staff raises. This makes it critical that the University increase the proportion of revenue it generates from other sources.

That endeavor is well underway, as the University seeks to close the operating budget deficits it has run the past several years.

Administrators are ramping up efforts to expand the University’s other revenue streams, most notably its endowment income and revenue from the School of Professional Studies.

Brown’s endowment, which had a market value of $3.3 billion at the end of last fiscal year, is currently the smallest of any Ivy League school’s.

The BrownTogether campaign — the $3 billion fundraising campaign launched in October — will be vital in growing it, Paxson said. A larger endowment will yield greater annual income for the operating budget even while keeping the percentage payout “relatively low,” she said.

“Over the long-term, that’s what will make Brown less reliant on tuition and a stronger institution,” Paxson said.

At Princeton, for example, an endowment of $22.7 billion produces enough annual income to fund 47 percent of the school’s fiscal year 2017 operating budget, while undergraduate tuition and fees constitute just 12.5 percent of revenue. As a result, Princeton is able to keep undergraduate charges lower than any other Ivy League school. In its two most recent budgets, Princeton has raised its financial aid budget more than it has increased the revenue it generates from tuition.

For Brown, though, “the annual increase in tuition revenue is typically the most significant source of incremental revenue to support the faculty, facilities and student services,” the URC wrote in its report this year. Endowment income represents 15 percent of revenue for fiscal year 2017.

The BrownTogether campaign has a goal of raising $500 million for financial aid alone, which would produce $25 million per year for the aid budget, Paxson said.

Another campaign goal is to double the percentage of the faculty whose salaries are supported by endowment income as opposed to the operating budget, Locke said. Currently, the endowment provides for 17 percent of Brown’s faculty budget, compared to about 50 percent at Harvard.

“If we can double that (percentage), that takes off a lot of pressure on the operating budget, which gives us a lot more flexibility,” Locke said.

The other revenue source slated to grow significantly is the School of Professional Studies, which houses executive master’s programs, pre-college summer programs and summer courses for undergraduates.

Currently, pre-college programs generate the lion’s share of the division’s revenue. But by next year, the School of Professional Studies will be running four executive master’s programs, each with about 25 to 30 students. While the size of these programs is small, tuition ranges from $85,000 to $130,000 per year depending on the program.

The expansion of these programs could drive School of Professional Studies revenue from $36 million in fiscal year 2017 — 3.6 percent of total University revenue — to $49 million by fiscal year 2020, according to preliminary estimates provided by the University.

After accounting for expenses, the school is projected to contribute $8 million to the University’s education and general budget in fiscal year 2017, up from $6.5 million this year, helping shrink the operating budget deficit.

Paxson also said she expects revenue from sponsored research to increase due to recent success obtaining grants.

***

Right now, there are no alarm bells ringing in University Hall about Brown’s sticker price, nor are there proactive administrative plans to curtail tuition growth.

Paxson reiterated that her priority is keeping the cost of attendance down for Brown’s lower- and middle-income students, while simultaneously running the University as efficiently as possible on the cost side.

She does not think the economic model in higher education is destined to break.

“If the entire market reaches a point where the unaided students are unable to pay for school, then I think that will suppress faculty salaries and will slow the growth of tuition for everybody,” she said. “There’s a set of market forces that will moderate tuition growth and keep it from getting too high.”

But Goodman, the admission consultant, foresees a different sequence of events for elite, expensive private institutions.

“There is going to be a middle-class family in the state of Pennsylvania that sees a tuition bill from Penn that’s way larger than the bill at (Pennsylvania State University’s) honors college and makes their decision based on that,” he said.

Brown and its peers are not at that point yet, he added, but it may be on the horizon.