Republican leadership of the Senate Finance Committee and the House Ways and Means Committee sent letters to 56 universities, including Brown, Feb. 8, asking about how the universities finance and spend their endowments with a response deadline of April 1. The purpose is to learn about how universities use their tax-exempt status for educational and charitable purposes, according to the letters.

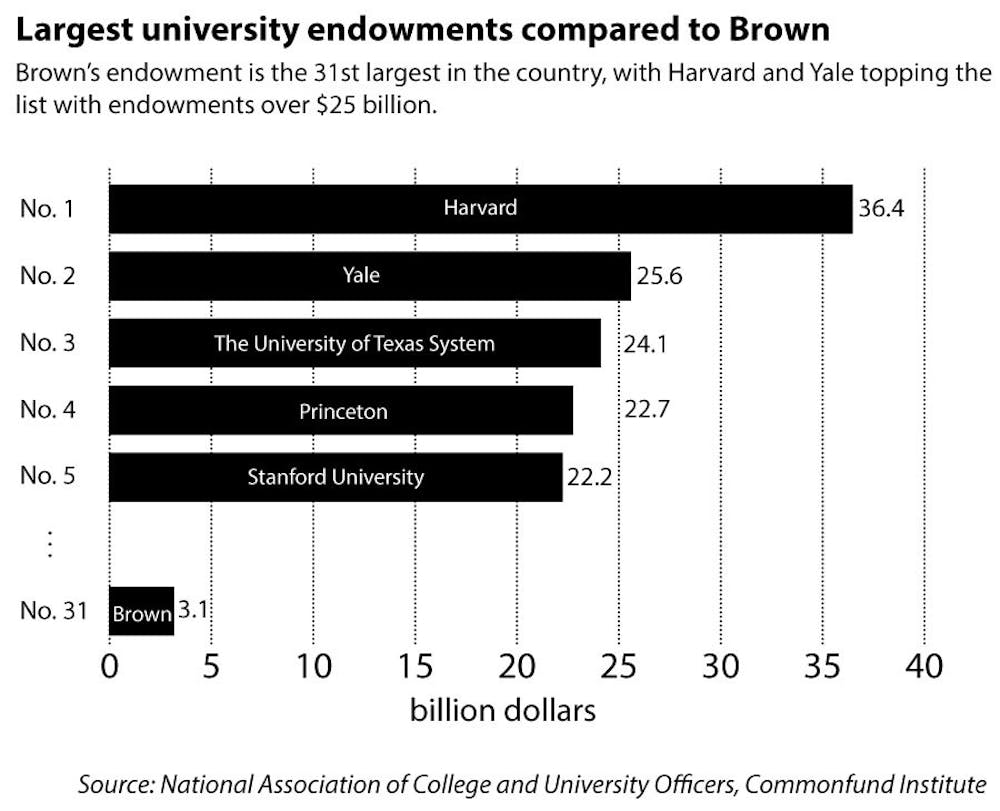

The letters addressed universities with endowments greater than $1 billion, including all eight members of the Ivy League.

U.S. Sen. Orrin Hatch, R-UT, chairman of the Senate Finance Committee, U.S. Rep. Kevin Brady, R-TX, chairman of the House Ways and Means Committee and U.S. Rep. Peter Roskam, R-IL, chairman of the House Ways and Means Oversight Subcommittee signed the letter.

Republicans in Congress wrote that the cost of higher education is skyrocketing even though university revenues are rising from both increased giving and better returns on investment, noting in the letter that tuition has risen faster than inflation. The letter also states that schools raised $40.3 billion in the year 2015 with total contributions to colleges rising 7.6 percent, and that endowments had an average rate of return of 15.5 percent in fiscal year 2014.

Vice President for Communications Cass Cliatt told The Herald that the University is reviewing the letter closely and taking the necessary steps to respond.

The letter’s 13 questions touched upon a range of topics, including the size, makeup, management cost and payout per year of the University’s endowment. Other questions asked about policies regarding spending the endowment principal, the percentage of the endowment devoted to financial aid and the makeup of donors — specifically, about policies related to conflicts of interest, naming rights and accepting restricted donations.

“I’m hopeful this process will allow us to learn more about how university endowments use their tax preferences to fulfill their charitable purposes,” Hatch said in a statement.

“The cost of higher education is just staggering for many American families. Is there a relationship between the tax code and that cost? That’s one of the questions we want to explore,” Roskam said in a statement.

Roskam held a hearing in October on endowment spending and the cost of higher education where some senators criticized universities for not spending enough of their investment returns. Other criticisms included large executive compensation and the rising cost of tuition.

Undergraduate tuition and fees will rise 4.4 percent at Brown during the 2016 fiscal year, and the Corporation recently approved a 7.1 increase in undergraduate financial aid, The Herald previously reported.

U.S. Sen. Tom Reed, R-NY, also proposed a bill in early January that would require universities with endowments above $1 billion to spend 25 percent of their annual endowment returns on financial aid for “working families” — families between 100 percent and 600 percent of the federal poverty line — or they would lose their tax-exempt status after three years of non-compliance.

The University recently increased support for middle-income families — where it lags behind its peers, according to the release. The policy will be evaluated at the end of the 2018-19 school year.

“The value of a Brown degree is extremely high, and Brown’s need-blind admission and scholarship support put Brown among the best,” wrote U.S. Sen. Sheldon Whitehouse, D-RI, in a statement to The Herald.

Rather than focusing on endowment spending, Whitehouse wrote that Republicans should instead focus on the Reducing Education Debt Act, “which would provide two years of free community college, boost Pell Grants and allow Americans to refinance student debt at lower interest rates.”

Other Congressional Democrats said focusing on student loans more broadly would reach more students and families.

U.S. Sen. Patty Murray, D-WA, said focusing on schools with endowments above $1 billion “doesn’t affect very many students.”

U.S. Rep. John Lewis, D-GA, also called the endowment spending a side issue.