The University’s three-year cohort default rate on federal direct student loans for students who began repaying their loans in 2011 decreased by about 35 percent from the previous year according to data released Sept. 22 by the U.S. Department of Education.

During fiscal year 2011, 1.3 percent of borrowers who entered loan repayment defaulted on their loans by Sept. 30, 2013, down from 2 percent the previous year.

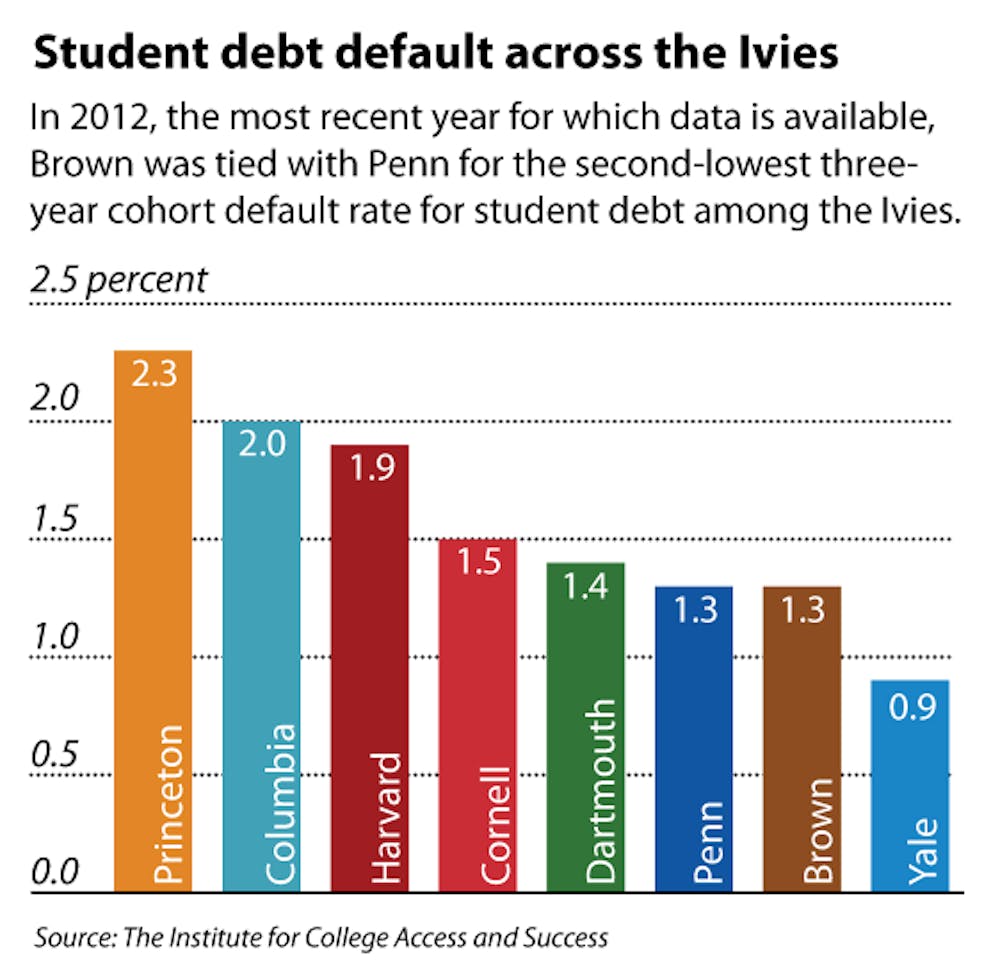

Other than Yale, which has a 0.9 percent default rate, Penn and Brown have the second lowest default rates among the Ivy League institutions.

“We changed our financial aid programs in 2008 and 2009,” said James Tilton, director of the Office of Financial Aid, adding that “students are borrowing more wisely.”

After the required entrance and exit interviews became an electronic process in 2009, the University piloted Get Your Bearings, a financial literacy program, to “provide more detailed, comprehensive information to students,” said Wynette Richardson, director of financial services. The program now includes topics ranging from loan repayment options to information about credit and credit scores, she said.

Tilton said they try to steer students toward the lowest interest loans and that the Financial Aid Office continues to provide support to alums after graduation.

“We haven’t seen a lot of movement in the past 10 years,” said Joel Carstens, Penn’s director of financial aid. Penn has seen a decreased number of students borrowing since the Great Recession, he said. He added that due to an all-grant, no-loan policy, Penn students who qualify for financial aid are able to graduate debt-free.

Though 2011 Princeton graduates had an average debt per borrower of $5,225, the university had the highest default rate among the Ivies for fiscal year 2011 at 2.3 percent.

The University’s default rate is lower than the national rate of 13.7 percent and the statewide rate of 10.4 percent. Rhode Island has the tenth lowest three-year default rate in the nation, according to Noel Simpson, deputy director and chief financial and compliance officer at the Rhode Island Student Loan Authority, a nonprofit state organization.

The three-year cohort default rate at Johnson and Wales University was the highest in the state for fiscal year 2011 at 11 percent.

Lynn Robinson, executive director of student services at JWU, said they are “working towards a 3 percent reduction” in the three-year cohort default rate for fiscal year 2012.

“If you have a low default rate, it doesn’t necessarily mean everything is perfect,” said Ben Miller ’07, senior policy analyst at New America — a nonprofit, nonpartisan organization that clarifies complex policy ideas and trends. A borrower can make occasional payments and avoid defaulting and still not be on track to pay back a loan in the appropriate amount of time, he said.

Miller said the default rate has a stronger correlation with graduation rates than the average amount of debt per borrower.

“It’s less about the absolute amount of money you owe and more about how much money you owe relative to how much money you’re making,” Miller said, adding that “someone who graduates college owing $25,000 but makes $35,000 is probably in better shape than someone who borrows $10,000 and goes into a job where they make $15,000 a year.”

According to the most recently released national data, of students who matriculated in fall of 2003 and defaulted by 2009, 63 percent had dropped out without finishing a program, Miller said.

“The schools that we perceive as the best and most elite tend to have very low default rates,” he said.

The overall graduation rate for Brown students who began their studies in the fall of 2007 was 95 percent, according to data released by the National Center for Education Statistics. The graduation rate for JWU students during that same year was 58 percent. Overall graduation rates for Penn were 96 percent for the class of 2011.

This year, the Financial Aid Office is expanding to provide students with better resources, Tilton said. “We’ve been trying to get more and more students involved,” he said, citing new information sessions available to student groups and organizations.

Both the Financial Aid Office and the Office for Student Loans have added one student to their staff, Tilton said. In cooperation with these student representatives, Tilton said he hopes to improve the financial aid website to make it more accessible to students.

Munashe Shumba ’11 said that he is grateful for his “very positive experience” with the Financial Aid Office, but he also said that “as far as managing my own finances, I think I got a lot more out of another course I took after I graduated.”

There are three Rhode Island Student Loan Authority college centers that provide financial literacy classes to students and parents statewide, said Simpson.

“We really pride ourselves in our ability to save parents and students money from borrowing, if they have to borrow,” he said. JWU has worked with RISLA since 2009 on counseling students on repayment and financial literacy, Robinson said.

A previous version of this article incorrectly stated that Penn has an all-grant, loan program. In fact, it has an all-grant, no-loan policy. The Herald regrets the error.

ADVERTISEMENT