A new report produced by the National Association of College and University Business Officers shows that the University’s percentage increase in investment returns from last year was in line with university endowments nationwide, which experienced a rebound in investment returns in fiscal year 2013.

The University’s endowment, currently sized at about $2.7 billion, saw an increase of 12.6 percent in investment returns from last year, The Herald reported in October.

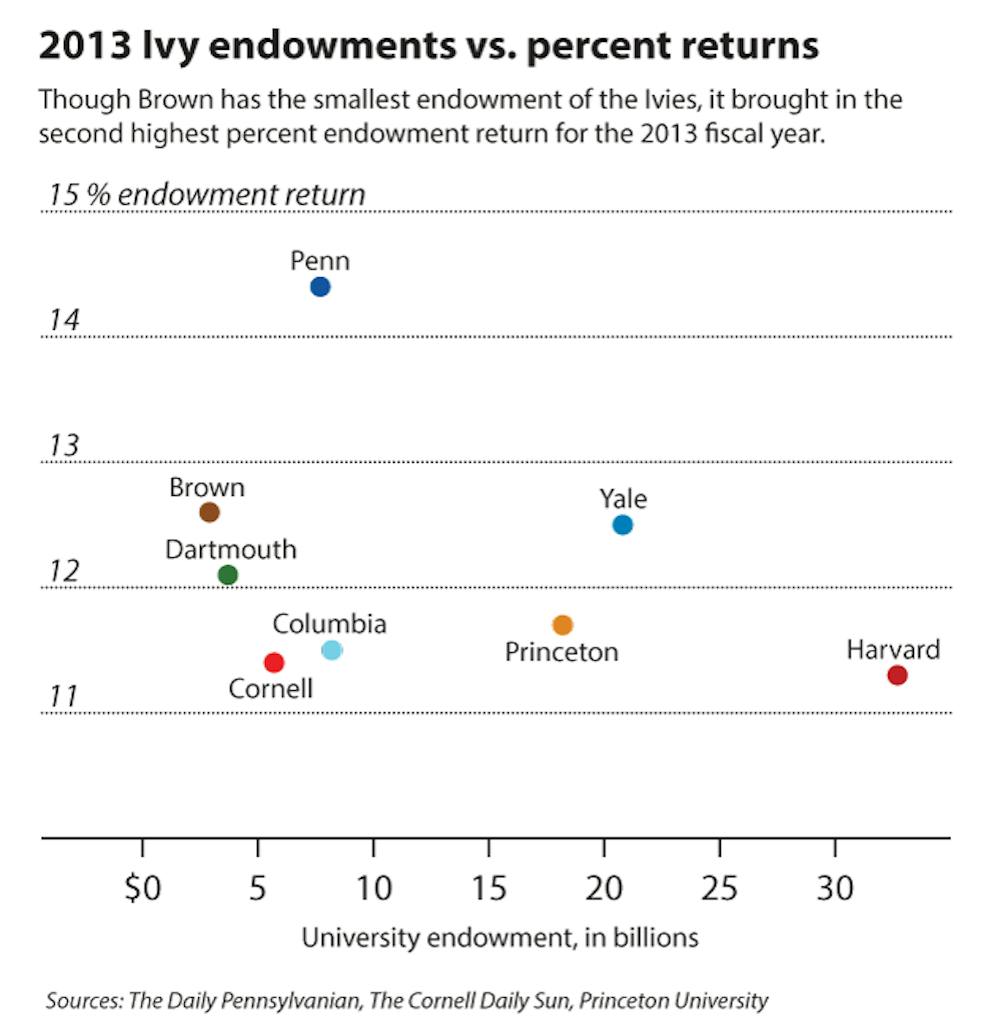

Among its Ivy peers, Brown’s endowment saw the second-most growth, trailing Penn, which reported a return increase of 14.4 percent. Yale, Princeton and Harvard also saw increases in their returns of 12.5 percent, 11.7 percent and 11.3 percent, respectively.

Much of this rebound can be accredited to surging financial markets, said Ken Redd, director of research and policy analysis at NACUBO. In fiscal year 2013, the U.S. stock market gained almost 21 percent, he said.

An endowment essentially comprises a series of funds that are designed to last into perpetuity, Redd said. At the University, a certain percentage of the endowment — known as a payout — is used each year for operations, said Beppie Huidekoper, executive vice president for finance and administration, adding that a portion of the remaining funds is then reinvested.

The average investment return for the surveyed colleges to be 11.7 percent for fiscal year 2013, NACUBO measured.

When the stock market crashed in 2008, the University’s endowment dropped a total market value of 27 percent, from about $2.8 billion to about $2 billion, Huidekoper said. At that time, the endowment represented around 17 percent of the University’s total revenue, leading to expenditure reductions and delays in capital projects, she said.

“In real terms, (the endowment’s) not worth what it was in 2008,” Huidekoper said, though she added that administrators are confident the University will continue improving its financial position. “We’ll get there.”

Draws from the endowment make up about 16 percent of the University’s total revenue, Huidekoper said.

Though NACUBO reported that higher education institutions’ endowments are on the rebound, other ratings agencies predict continued struggles for the financial positions of colleges and universities.

In its Outlook Report for 2014, released Nov. 25, Moody’s cited “flat to declining governmental funding” and “slowly growing revenue eclipsed by pressure to increase expenses” as ongoing concerns for higher education.

Declining federal funding is a challenge for the University, Huidekoper said.

Most of the University’s revenue comes from tuition, followed by federal funding for research and then the endowment, Huidekoper said. The University does not draw as much from its endowment as do some of its Ivy League peers, such as Harvard and Princeton, she added. Harvard has the largest endowment of any higher education institution in the world, with $32.7 billion in total endowment assets at the end of fiscal year 2013.

ADVERTISEMENT