Gov. Gina Raimondo’s proposed budget plan, released Jan. 17, included a cut to Rhode Island’s Payment In Lieu Of Taxes program that could lead to new taxes on the University’s non-mission related properties.

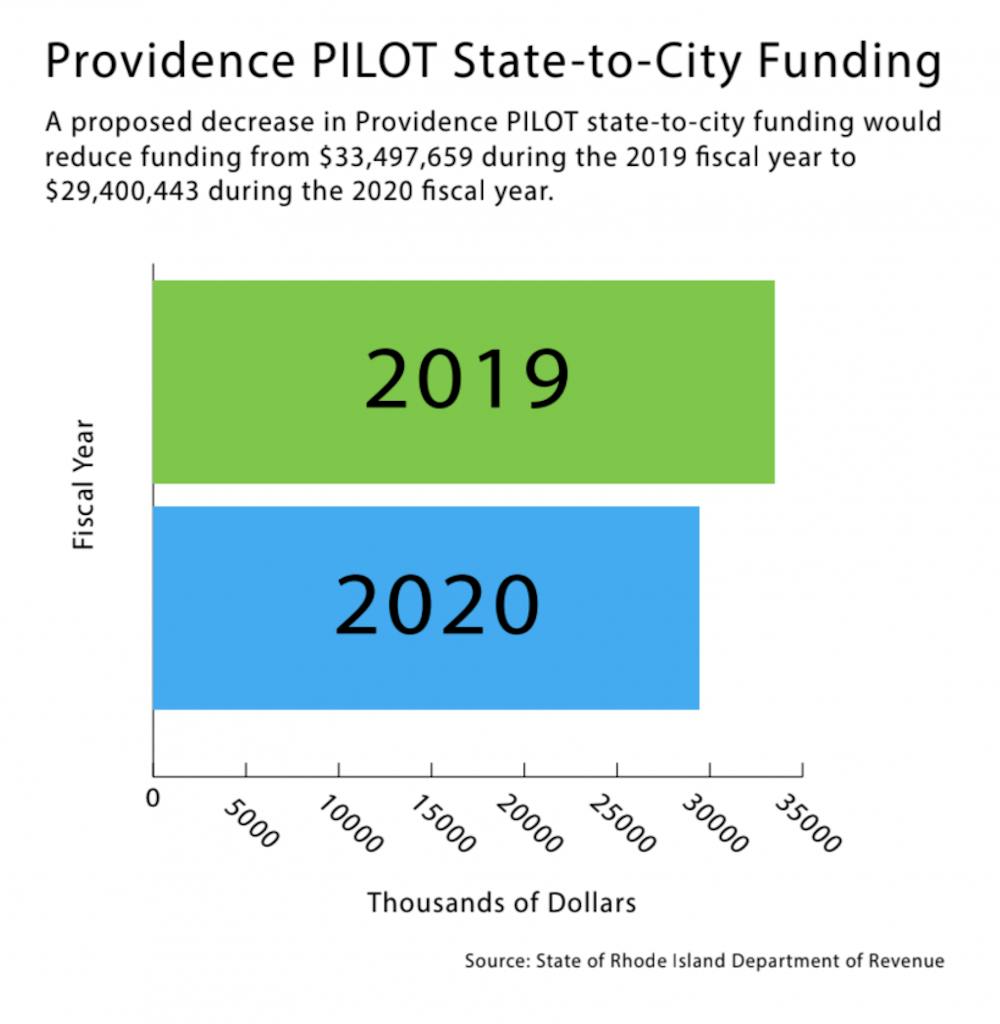

If approved, the budget plan would cut approximately $6 million from Rhode Island’s PILOT program, which reimburses municipalities for taxes that nonprofit, tax-exempt institutions — including the University — do not pay. Compared to other states’ PILOT programs, Rhode Island’s current program is “considerably more expensive to state taxpayers,” wrote Brenna McCabe, public information officer for the Rhode Island Department of Administration, in an email to The Herald.

While the budget cut to PILOT saves money statewide, it would leave a gap in Providence’s budget this year. Since PILOT funding is applied to the previous fiscal year’s budget, Providence would face an unexpected $4 million budget gap this fiscal year, according to Emily Crowell, senior advisor for Mayor Jorge Elorza. “The mayor and the Providence delegation will continue to advocate for this funding to be restored,” Crowell wrote in an email to The Herald.

In her budget plan, Raimondo proposed “additional tools for municipalities to tax non-mission-related commercial property owned by large nonprofit institutions,” McCabe wrote in an email to The Herald. Raimondo hopes that these taxes would offset the proposed cuts to PILOT funding.

“We oppose any measure to implement a tax directly on nonprofit higher education institutions,” wrote Director of News and Editorial Development Brian Clark in an email to The Herald.

Currently, the University and its real estate subsidiary, Farview, Inc., pay property taxes to Providence. In FY18, those payments totaled $1.64 million, according to Clark. In the same year, the University contributed an additional $4.38 million in voluntary payments to Providence in accordance with the University’s 2003 and 2012 agreements with the city. The voluntary payments include those on previously commercial properties that were subject to real estate taxes before their acquisition by the University for institutional use.

Regardless of changes to the PILOT program, the University will continue its voluntary payments to Providence, according to Clark.

“Our voluntary agreements are part of a strong relationship between Brown and Providence, and we don’t want to see that partnership undermined by a new tax aimed at generating funds we’re already contributing,” Clark wrote.

The state legislature will adopt a final budget in June.