The University launched a $120 million initiative with the ultimate goal of eliminating loans from all undergraduate financial aid packages, President Christina Paxson P’19 announced in a community-wide email Wednesday.

If $30 million of the initiative, called “The Brown Promise: The Future of Financial Aid at Brown,” is raised by this December, grants will replace loans in aid packages for incoming and current students for the 2018-19 academic year, Paxson wrote. The change will apply to both domestic and international students.

The campaign aims to help middle income students who do not qualify for no-loan financial aid but still need aid, according to a University press release. Such students often graduate with debt.

For the 2017-18 school year, 1138 students who receive University need-based aid had loans in their initial packages, Dean of Financial Aid Jim Tilton wrote in an email to The Herald. Of these students, 883 are not seniors, meaning they will be eligible for the no-loan policy in the 2018-19 school year.

“It’s clear that debt is a deterrent to students to coming to Brown,” Paxson said. “It hurts us because we’re not getting the students that we want, and it hurts them because they’re not getting to go to the school that they want to attend. Student debt is something that is really at odds with everything we value as part of the Brown curriculum.”

The University has seen fewer applicants and lower yields among students who need loans in their packages, causing “an issue of diversity,” Paxson said. “We need to make sure that all economic groups (and) social groups are represented at Brown.”

Dean of Admission Logan Powell believes the Brown Promise initiative will be “transformative” in this aspect by making the University “more attractive (for) students from moderate income backgrounds.” Offering the no-loan policy will ultimately give students the opportunity to choose schools “based on fit” rather than cost, Powell said.

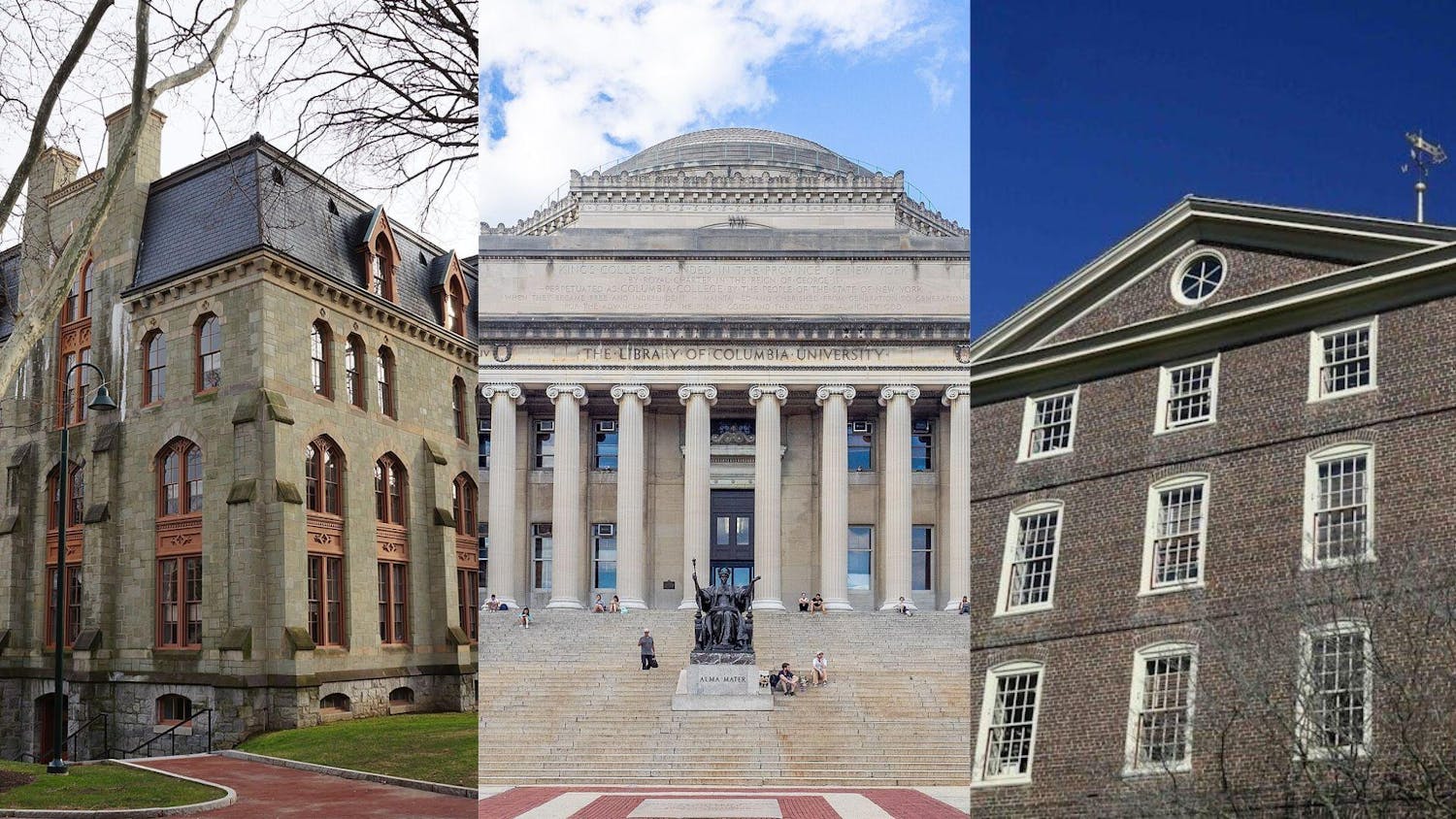

If implemented, Brown will join the majority of the Ivy League in using a no-loan policy as part of undergraduate financial aid.

“Factually speaking, when students apply to Brown they also to apply to Harvard, Yale, Princeton, Stanford, Columbia and Penn for the most part,” Powell said. “All of those institutions have gone to a no-loan policy so in that group of schools — we are the only one without a no-loan policy.”

Paxson hopes this will make the University more competitive against peer institutions. Without the no-loan policy, accepted students are “choosing away from Brown because they can’t afford it, and they’re getting better offers elsewhere,” Paxson said.

The $120 million campaign is part of a larger $500 million campaign effort for undergraduate financial aid within the $3 billion BrownTogether campaign that was launched in 2015, according to the press release.

Though Paxson acknowledged the $30 million goal is “an ambitious goal for a short period of time,” she is “confident the Brown community is going to step up.”

At The Corporation’s last meeting in February, the University accepted over $62 million in gifts and pledges made since October 2016, according to a University website. The Corporation’s next meeting is October.

So far, the University has around $5 million in documented pledges, Director of News and Editorial Development Brian Clark wrote in an email to The Herald. “There are also many other conversations underway with potential donors,” Clark added.

“We’re going to get some big endowed gifts, I hope, from very generous people who have a lot of capacity to give,” Paxson said. She also added that she hopes the campaign “will attract the interest of a very broad, broad segment of the Brown community” to meet “this goal with many, many people supporting it at small levels.”

The Brown Promise requires approximately $4.5 million more funds added to the yearly financial aid budget, Powell said. The $120 million goal will go toward these additional funds, $100 million of which are endowed funds and $20 million of which are “current-use” funds, according to a University press release. The $20 million “current-use” funds will cover four years worth of the no-loan policy, while the $100 million will go towards covering the costs in perpetuity, Powell said.

Though currently operating under a budget deficit, the University continues to pursue “continued investment in academic priorities” while also trying to sustain “long-term fiscal stability,” Clark wrote. “By contributing to initiatives such as the Brown Promise, donors to Brown play a critical role in supporting the University in this effort,” Clark added.

Correction: A previous article quoted Dean of Admission Logan Powell saying the Massachusetts Institute of Technology has a no-loans policy. In fact, MIT does not have a no-loans policy. The Herald regrets the error.