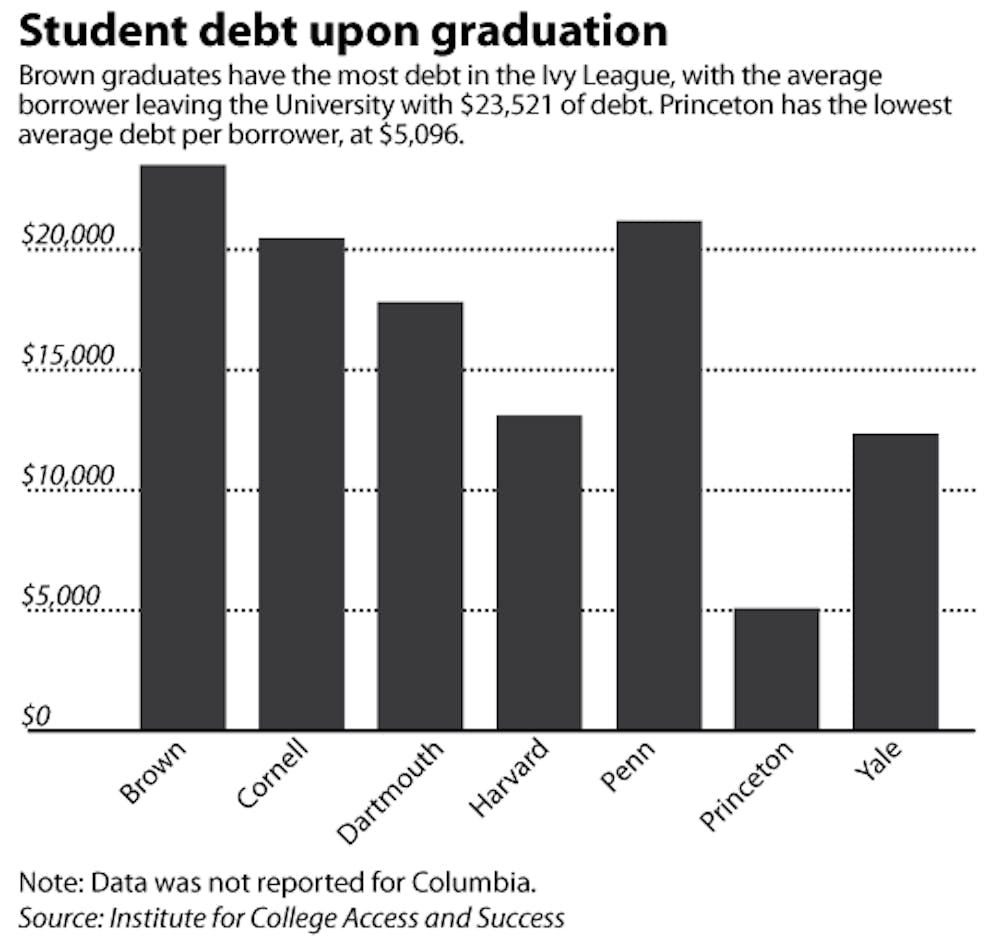

Students who graduated from Brown in 2012 left with an average debt of $23,521 per borrower — the highest in the Ivy League — according to the latest numbers from the Project on Student Debt, an annual report published by the nonprofit Institute for College Access and Success.

Brown students’ average debt sum has increased about 15 percent from 2011, when it totalled $20,455.

The amount of debt varies from year to year as families make decisions about how to fund students’ educations, but in the “last five graduating classes, there was a difference of only a few thousand dollars,” said Jim Tilton, director of financial aid.

Brown’s number was lower than the national average of $29,400.

The “maximum amount that students are required to borrow as part of (their) aid package hasn’t increased since 2008-2009,” Tilton said.

Penn had the second-highest average debt burden in the Ivy League with $21,190 per student borrower. “The average debt has been very stable from one year to the next,” said Joel Carstens, the university’s director of financial aid.

In 2008, Penn implemented an all-grant, no-loan policy, which means that students eligible for financial aid receive aid packages that do not include loans from Penn. As students from the first classes admitted under the new policy have begun to graduate, the percentage of students graduating with debt has dropped from about 50 percent to 38 percent, Carstens said.

“The good news is we have fewer students borrowing,” he said, adding that for those who are, “the amount they’re borrowing hasn’t changed significantly over time.”

Among Rhode Island institutions, Brown has the second-lowest average debt of graduating borrowers, behind only Rhode Island College, a public institution, according to the report. The average debt for a college graduate in Rhode Island in 2012 was $31,156 — the fifth-highest in the nation, according to TICAS. At $44,580 for 2012 graduating borrowers, Bryant University had the highest average debt total in the Ocean State.

Graduating borrowers from Salve Regina University, which had the second-highest average debt in the state, had the highest amount in the school’s history in 2012, said Aida Mirante, Salve Regina’s director of financial aid. This was due to a number of factors, including decreased use of federal Parent Loans for Undergraduate Students, which are not included in average loan debt because of higher interest rates, she said. As a result, many parents opted to borrow lower-interest private loans, which are included in debt averages, she added.

The economy also played a factor in the 2012 averages, Mirante said. “Kids who started as freshmen when the economy went south (in 2008) graduated in 2012,” she said.

Due to the financial situation in the country, parents who “earmarked some of their investments” to help pay for tuition might “have lost a good percentage of those investments,” Mirante said.

On the whole, “college costs continue to rise, and family income and available grant aid have not been keeping up,” said Matthew Reed, program director at TICAS.

Nationally, for the class of 1993, the average debt of graduating borrowers was $9,250, and under 50 percent of students graduated with debt. These figures jumped to $29,400 for the graduating borrowers in the class of 2012, 71 percent of whom graduated with debt, according to numbers provided by the Project on Student Debt. These numbers do not account for inflation.

“Most undergraduates attend public colleges, and at those colleges, state support declined, and tuition and fees have gone up,” Reed said. He attributed part of the reduced support for public universities to the economic downturn, which led to “states having budget crunches.”

At Brown, the Office of Financial Aid spends “a considerable amount of time sitting down with families” to determine their best financing approach, advising them on whether loans are appropriate for their situation, Tilton said.

He added that the average default rate for Brown graduates was 1.7 percent, which is much lower than the national average of 13.4 percent.

“The default rate at an institution gives a sense of how students are managing to pay off their student loan debt,” he said.

One problem with reporting student loan debt averages stems from the fact that not all colleges voluntarily report their data, Reed said, adding that students from colleges that did not report their data account for approximately 9 percent of the class of 2012 nationwide.

ADVERTISEMENT